Answer:

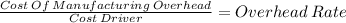

COGS 3807 debit

FG 7896 debit

WIP 2397 debit

Factory Overhead 14,100 credit

--to record the underapplication of overhead--

Step-by-step explanation:

overhead rate:

$515,000 overhead / 515,000 labor cost = $1

each labor cost generates a dollar of overhead.

221,400 x 1 = 221,400 overhead in COGS

459,200 x 1 = 459,200 overhead in Finished Goods

139,400 x 1 = 139,400 overhead in WIP inventory

Total applied 820,000

Actual 805,900

Underapplied 14,100

Now we weight each concept and determiante the portion underapplocated in each concept

![\left[\begin{array}{cccc}Item&Value&Weight&Allocated\\COGS&221400&0.27&3807\\FG&459200&0.56&7896\\WIP&139400&0.17&2397\\&&&\\Total&820000&1&14100\\\end{array}\right]](https://img.qammunity.org/2021/formulas/business/college/hu6etmissu5w3tltnp8c86sih0zfsj9fnv.png)