Answer:

Captilaziation rate 8.80%

Intrinsic value of the stock $ 189.29

Step-by-step explanation:

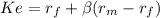

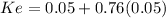

First we solve for the cot of capital (required return) using CAPM

risk free = 0.05

market rate = 0.1

premium market = (market rate - risk free) 0.05

beta(non diversifiable risk) = 0.76

Ke 0.08800

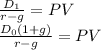

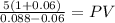

Now, we solve the horizon value using the gordon model formula:

PV 189,2857