Answer:

Work-In-Process 364,000 debit

Factory Overhead 364,000 credit

--actual costing--

Work-In-Process 184,800 debit

Factory Overhead 184,800 credit

--with a predetermined overhead rate--

Step-by-step explanation:

If we do an actual costing then, we post into WIP the actual overhead cost.

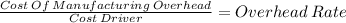

If we do it with a predetermined overhead rate then:

$336,000 expected overhead / 20,000 machine hours = $16.8

Now, the applied overhead will be this rate times the machine hours used:

$ 16.8 x 11,000 machine hours = $ 184,800