Answer:

Price of the stock today = $53.14

Step-by-step explanation:

given data

dividends year D1 = $12

dividends year D2 = $10

dividends year D3 = $9

dividends year D4 = $4

constant growth rate = 6 percent

required return stock Kk = 15 percent

solution

we get here Price of the stock today that is

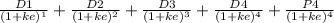

Price of the stock =

.................1

.................1

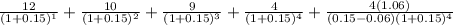

here P4 =

.............2

.............2

and where D5 = D4(1+g) .............3

so here put value in equation 1

Price of the stock today =

Price of the stock today = 53.1368

Price of the stock today = $53.14