Answer:

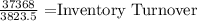

A/R TO 9.77

Days on Inventory 37

YES As it weight as almost half of the current assets of the company

Step-by-step explanation:

The financial statement post the current year first and the last year in the secodn column therefore, the second colum is the year 2013 and my calculation will be based on that.

2014 2013

Accounts receivable (gross) $3,697 $4,835

Accounts receivable (net) 3,460 4,187

Allowance for doubtful accounts 237 648

Sales revenue 37,368 39,579

Total current assets 7,254 7,69

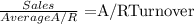

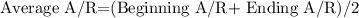

where:

Sales 37,368

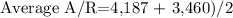

beginning 4,187

ending 3,460

Avg. A/R 3823.5

A/R TO 9.77324441

Days on Inventory 37

3,460 / 7,254 = 0.4769