Answer:

$390000

Step-by-step explanation:

Given: Beginning inventory= $60000

Cost of goods purchased = $380,000

Sales revenue= $800000.

Ending inventory= $50000.

The Periodic inventory system is used to determine the amount of inventory available at the end of each accounting period.

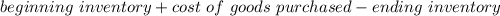

Cost of goods sold=

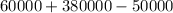

⇒ Cost of goods sold=

⇒ Cost of goods sold=

∴ Cost of goods sold=

.

.

Hence, $390000 is the cost of goods sold under a periodic system.