Answer:

Step-by-step explanation:

The price of a stock can be modeled by the present value of the stream of future dividends discounted at a rate equal to the return expected.

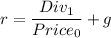

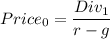

The equation, when the dividends are expected to grow at a constant rate, less than the return rate is:

Where:

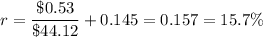

- Price₀ is the current price: $44.12

- Div₁ is the dividend to be paid a year from now: $0.46 × 1.145 = $0.53

- g is the expected constant growth rate: 14.5% = 0.145

Then, you can solve for r: