Answer:

The amount to deposit in the first month will be $35708.91

Step-by-step explanation:

The formula to apply here is:

where

A=future value of loan including interest

P=Initial deposit

r=annual interest rate in decimal

n=number of times interest is compounded per unit t

t=time money is borrowed

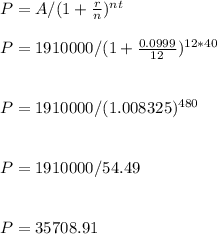

Given in the question;

t=40 yrs

A=$1910000

r=9.99% =0.0999

n=12

P=?

Applying the formula to find P

The amount to deposit in the first month will be $35708.91