Answer:

1. Future value (FV) = $4,717

2. Future value (FV) = $5,189

3. Future value (FV) = $5,237

Step-by-step explanation:

Requirement 1

Assume that the present value of the investment is $1,000.

We know, Compounding yearly,

FV = PV*(1 + i)^n

Given,

Present value (PV) = $1,000

Interest rate, i = 13.8% = 0.138

number of periods, n = 12 years

We have to calculate the future value of the investment.

Therefore,

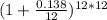

FV = $1,000 ×

or, FV = $1,000 ×

or, FV = $1,000 × 4.7174

Therefore, Future value (FV) = $4,717

Requirement 2

Again, Assume that the present value of the investment is $1,000.

We know, Compounding monthly,

FV = PV ×

Given,

Present value (PV) = $1,000

Interest rate, i = 13.8% = 0.138

number of periods, n = 12 years

compounding period (monthly), m = 12

We have to calculate the future value of the investment.

Therefore,

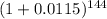

FV = $1,000 ×

or, FV = $1,000 ×

or, FV = $1,000 ×

or, FV = $1,000 × 5.1890

Therefore, Future value (FV) = $5,189

Requirement 3

Again, Assume that the present value of the investment is $1,000.

We know, Compounding daily,

FV = PV ×

Given,

Present value (PV) = $1,000

Interest rate, i = 13.8% = 0.138

number of periods, n = 12 years

compounding period (daily), m = 365

We have to calculate the future value of the investment.

Therefore,

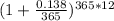

FV = $1,000 ×

or, FV = $1,000 ×

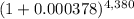

or, FV = $1,000 ×

or, FV = $1,000 × 5.2367

Therefore, Future value (FV) = $5,237