Here is the full question:

Workman Software has 10.6 percent coupon bonds on the market with 17 years to maturity. The bonds make semiannual payments and currently sell for 108.1 percent of par.

What is the current yield on the bonds?

Answer:

9.81%

Step-by-step explanation:

Given that:

Coupon rate of bond = 0.106 %

Years of maturity = 17 years

n = 17 × 2 = 34

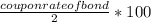

Interest =

=

= $53

The current selling price on bonds = $1000 × 108.1%

= $1000 × 1.081

= $1081

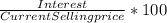

Current yield =

=

= 9.81%