Answer:

$14620 is collected as tax for a property of $860,000

Step-by-step explanation:

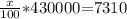

Let the tax rate on every property in Tacoma be x%. A property worth $430,000 was taxed $7,310. This implies that:

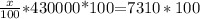

multiplying through by 100 we get:

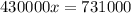

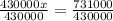

Dividing through by 430000 to get:

x = 1.7%

Therefore the tax rate in Tacoma is 1.7%.

Since all tax rate is proportional, for a property of $430,000 the tax is $7,310, for a property of $860,000 let the tax be $y

Therefore

This means that $14620 is collected as tax for a property of $860,000