Answer:

In 2022, Rigs-by gross profit=$682,500

Step-by-step explanation:

Profit=Price at which land is sold- Actual price of land

Profit=$5,000,000- $3,500,000

Profit=$1,500,000

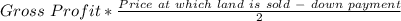

Gross Profit=Profit/Price at which land is sold

Gross Profit=$1,500,000/$5,000,000

Gross Profit=0.3=30%

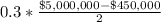

In 2022, Rigs-by gross profit=

In 2022, Rigs-by gross profit=

In 2022, Rigs-by gross profit=$682,500