Answer:

The maximium cost I would be willing to purchase the asset is 26.033,84 above this price the investment will not yield the 6% return.

Step-by-step explanation:

We calcualte the present value of all cash flows:

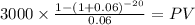

annual cashflow:

15,000 revenue - 2,000 expenses = 3,000

C 3,000.00

time 20

rate 0.06

PV $34,409.7637

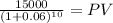

Pv of the 10th year investment:

Maturity $15,000.0000

time 10.00

rate 0.06000

PV 8,375.9217

present value of the cashflow

34,409.7637 - 8,375.92 = 26.033,84