Answer:

Share price : $ 56.23

Step-by-step explanation:

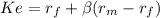

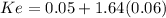

CAPM

risk free = 0.05

market rate = 0.11

premium market = (market rate - risk free) 0.06

beta(non diversifiable risk) = 1.64

Ke 0.14840

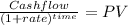

Now, we solve for the present value of the future dividends:

year dividend* present value**

1 2.91 2.53

2 3.31 2.51

3 3.78 2.49

4 4.31 2.48

4 80.38 46.22

TOTAL 56.23

*Dividends will be calculate as the previous year dividends tiems the grow rate

during the first four year is 14%

then, we calcualte the present value of all the future dividends growing at 9% using the dividend grow model:

(4.31 x 1.09) / (0.1484 - 0.09) = 80.38

Then we discount eahc using the present value of a lump sum:

We discount using the CAPM COst of Capital of 14.84%

last we add them all to get the share price: $ 56.23