Answer:

amount pay = 32.91

Step-by-step explanation:

given data

grow at a rate g = 19% = 0.19

time = 5 year

expecting to grow Eg = 5 % = 0.05

paid a dividend D = $1.25

required rate of return Rg = 12%

solution

we get here amount that pay for company's stock is express as

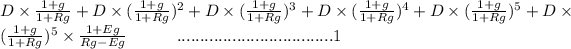

amount =

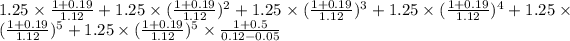

put here value and we get

solve it we get

amount pay = 32.91