Answer:

1. WACC = 11.26% (using classical CAPM)

2. WACC = 11.22% (using tax-adjusted CAPM)

Step-by-step explanation:

The Weighted Average Cost of Capital (WACC) is the cost of capital of a firm where its equity and debt structure is proportionate.

The CAPM is two types, classic CAPM and tax-adjusted CAPM.

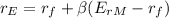

Classic CAPM Formula:

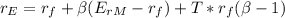

Tax adjusted CAPM Formula:

** same way for

, cost of debt

, cost of debt

Where

is the cost of equity

is the cost of equity

risk free rate

risk free rate

is the volatility

is the volatility

is the market return

is the market return

T is the tax rate

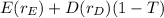

Also, formula for WACC is:

WACC =

Where

E is percentage of equity of the firm

D is the percentage of debt in the firm

is cost of equity

is cost of equity

is cost of debt

is cost of debt

T is tax rate

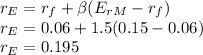

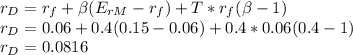

Now, using classical CAPM Approach:

Cost of Equity:

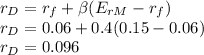

Cost of Debt:

WACC:

THus,

WACC = 11.26%

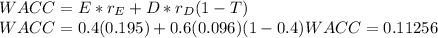

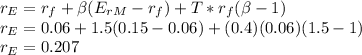

Using Tax adjusted CAPM:

Cost of Equity:

Cost of Debt:

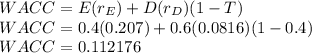

Now, WACC:

Thus,

WACC = 11.22%