Answer:

$31.9211

Step-by-step explanation:

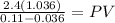

We discount the future two year dividends at the required rate of return

and solve for the present value of the infinite series of dividends growing at 3.6% with the dividend grow model:

PV 33.6

Then we discount this by the two years ahead of time these cashflow start and add them to get the PV of the stock which is their intrinsic market value

![\left[\begin{array}{ccc}Year&cashflow&PV\\&&\\1&3&2.7027\\2&2.4&1.9479\\2&33.6&27.2705\\&TOTAL&31.9211\\\end{array}\right]](https://img.qammunity.org/2021/formulas/business/college/1pmokn3t9wokg73qzu53gzxpsvgaqw7p3r.png)