:

The price of the Bond is $4887

Step-by-step explanation:

Bond price can be defined as the present discounted value of future cash stream generated by a bond. In other words, it is the sum of the present values of all likely coupon payments plus the present value of the par value at maturity. To calculate the bond price, one can apply the formula stated below.

Bond Price =

+

+

Where,

F = The face/par value

C = Coupon payment

n = Number of periods till maturity

r = Yield to maturity

From the question

C = $5,000 *4.2% = $210

F = $5,000

n = 16

r = 4.4%

now (1+r) = 1+0.044 = 1.044

=

=

=1.9916

=1.9916

=

=

=0.502

=0.502

Substituting into the formula we have

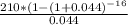

Bond Price =

+

+

Bond Price =

+

+

= 2376.8 +2510.54 =4887.358

The price of the Bond is $4887