Answer:

1) $ 54.82

2) it will invest 451.80 dollars in the bank account

3) $74.36

4) $ 1.281,7

Step-by-step explanation:

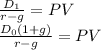

We solve for the current price of Goliath using the dividend growhth model:

![\left[\begin{array}{ccc}Years&Cashflow&Discounted\\&&\\1&2&1.74\\2&2.6&1.97\\3&3.38&2.22\\3&74.36&48.89\\&total&54.82\\\end{array}\right]](https://img.qammunity.org/2021/formulas/business/college/vv4enuchgf6o9hnfqvx2s2wh86se9v3jp9.png)

After the third dividned the value of the future dividends growing at 10% is calcualte using the gordon model:

3.38(1+0.10)/(0.15-0.1) = 74.36

Then we discount using the lump sum formula:

we use the rate of 15% which is the required return

10 shares x 54.82 = 548.2

1,000 - 548.2 = 451.8

At the third dividend is paid out the value of the shares will be of 74.36 as it is the discounted value of the futures dividends growing at 10%

10 shares x 74.36 = $743.6

451.8 capitalized during 3 years at 6%

Principal 451.80

time 3.00

rate 0.06000

Amount 538.10

Total: 538.10 + 743.6 = 1.281,7