Answer:

I would purchase stocks from Nathan's Bakeries which is above their cost of capital according to CAPM

Step-by-step explanation:

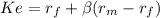

We will purchasethe stock based on the CAPM cost of capital to know if the expected return is above or equal to CAPM.

risk free = 0.05

market rate = 0.12

premium market = (market rate - risk free) 0.07

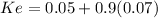

Anderson, Inc.

beta(non diversifiable risk) = 0.9

Ke 0.11300 = 11.30%

Expected return 10.5%

NO as it is lower than CAPM

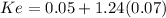

Delta Vanlines

beta(non diversifiable risk) = 1.24

Ke 0.13680 = 13.68%

return 13%

NO as it is lower than CAPM

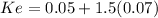

Nathan's Bakeries

beta(non diversifiable risk) = 1.5

Ke 0.15500 = 15.50%

return 16%

YES as it is hihger than CAPM

Z-man Electronics

beta(non diversifiable risk) = 2.15

Ke 0.20050 = 20.05%

return 19%

NO as it is lower than CAPM