Answer:

The correct option is option B which is the effective yield of the corporate bond is higher.

Step-by-step explanation:

The complete question is not given so it is found online and is attached herewith.

In order to compare the tax free municipal yield to the taxable corporate yield, the two must be equalized.

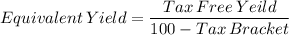

So the equalization of the yield is given by

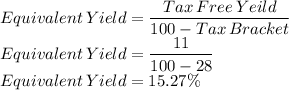

Here the Tax Free Yield is 11%

The Tax bracket is 28%

So the equivalent yield of the municipal bond is given as

Now the options are as below

A. The effective yield on the municipal bond is higher

B. The effective yield on the corporate bond is higher

C. Both effective yields are equivalent

D. The coupon rates for each bond are necessary to determine the effective yield

As the effective yield of municipal bond is 15.27% while that of the corporate bond is 16% so the correct option is option B which is the effective yield of the corporate bond is higher.