Answer:

Q = 15

profit at q=15 $800

Step-by-step explanation:

To maximize their profit it will produce until the marginal cost equalize the marignal revenue.

As the price is 120 each additional unitgenerates 120 dollars of revenue.

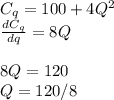

Now, we solve for the marginal cost

Q = 15

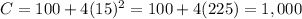

Total cost

Profit

$120 x 15 units - $1,000 cost = 800