Answer:

Degree of Financial Leverage = 0.64

Step-by-step explanation:

Degree of Financial leverage refers to the proportion of debt in the capital structure of a company. It also signifies earnings for shareholders i.e per share earnings of shareholders (EPS) with respect to operating income earned by a company.

In the given case, eps before = $1.25

eps afterwards = $1.37

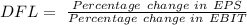

Degree of financial leverage is expressed as:

Wherein,

EPS = Earnings per share

EBIT = Earnings before interest and taxes

Percentage change in EPS =

= 9.6%

= 9.6%

Percentage change in EBIT = 15%

Hence Degree of Financial Leverage =

= 0.64

= 0.64