Answer:

net wortht -143,280.85

equivalent annual cost $ 24,932.98

Step-by-step explanation:

We sovle for the present value of each annuity:

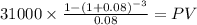

The first three years:

C 31,000.00

time 3

rate 0.08

PV $79,890.0066

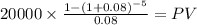

Then the second phase annuity:

C 20,000.00

time 5

rate 0.08

PV $79,854.2007

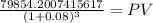

NOw, we discount this as it is three years into the future

Maturity $79,854.2007

time 3.00

rate 0.08000

PV 63,390.8391

Total net worth:

79,890.0066 - 63,390.8391 = -143,280.85

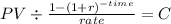

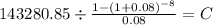

The EAC will be the annuity which makes the Present work

PV 143,280.85

rate 0.08

time 8

C $ 24,932.983