Answer:

Step-by-step explanation:

Rate of Return

The rate of return RoR is the net gain or loss on an investment over a time period, expressed as a percentage of the investment's initial cost.

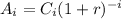

If C1, C2, ..., Cn are the net cash flows at each period of investment, then the actual value of each one of them is

where r is the rate of interest assumed for the investment.

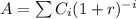

The total value of the cash flows is

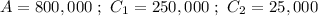

We have the final value of the investment at the present time

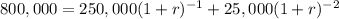

We can find the r as the RoR of the investment by setting the equation

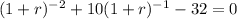

Simplifying by 25,000 and rearranging

This is a second-degree equation for

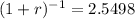

. Solving the equation we get only one positive value:

. Solving the equation we get only one positive value:

Or, equivalently

We get a negative RoR