Answer:

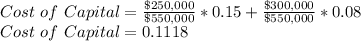

Cost of capital=11.18%

Step-by-step explanation:

First We will calculate the Equity of firm:

Equity= Number of share* Book value per share

Equity= 10,000* $25

Equity= $250,000

Long-term debt=$300,000

Expected rate of return=15%=0.15

Current yield to maturity (rdebt)=8%=0.08.

Value of firm=Equity+Long-term debt

Value of firm= $250,000+$300,000

Value of firm= $550,000

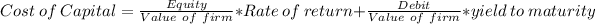

Formula:

Cost of capital=11.18%