Answer:

correct option is a) $66.68 per share

Step-by-step explanation:

given data

1. 2015: $1.00

2. 2016: $1.25

3. 2017: $1.50

earnings per share = $4.50

P/E ratio = 20

required rate of return = 12%

solution

we get here Market Price per share that is express as by P/E Ratio

P/E Ratio = Market Price per share ÷ Earnings per share .............1

put here value and we get

20 = Market Price per share ÷ $4.50

Market Price per share = 20 × $4.50

Market Price per share = $90

and

earn 12% of return

so here discount all the expected dividend and market price to present value

use here an required rate of return as discount factor

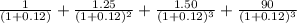

present value of all amounts =

solve it we get

present value of all amounts = 66.7

so maximum amount that is paid to earn 12% return is $66.7

so correct option is a) $66.68 per share