Answer:

the present value of the lease obligation for lease A will be $1,702,712.74 while the present value of lease B will be $1,764,741.73

Explanation:

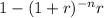

the present value of annual lease payment will be determined by discounting the total amount to be received from lease payment over years.

for lease A , Pv = A

= $200,000( 1 - (1+0.1)

) / 0.1 = $1,702,712.74

) / 0.1 = $1,702,712.74

for lease B , Pv = $220,000( 1 - (1+0.1)

) / 0.1 = $1,764,741.73

) / 0.1 = $1,764,741.73

the amount to be dicloased in the balance sheet at 31 december, 2018