Answer:

1.19

Step-by-step explanation:

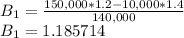

The beta of a portfolio can be simply determined by a weighted average of each individual investment's beta. Thus, the portfolio beta after selling $10,000 of a stock with beta equal to 1.4 is:

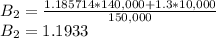

The beta of a new portfolio after purchasing $10,000 worth of a new stock with beta equal to 1.3 is:

The beta of the new portfolio is 1.19.