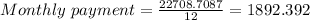

The monthly payment is $ 1892.392

Solution:

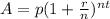

The formula for compound interest, including principal sum, is:

Where,

A = the future value of the investment

P = the principal investment amount

r = the annual interest rate (decimal)

n = the number of times that interest is compounded per unit t

t = the time the money is invested or borrowed for

From given,

p = 12500

t = 5 years

n = 12 ( compounded mothly )

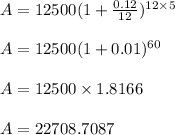

Substituting the values we get,

What will her monthly payment be?

Thus monthly payment is $ 1892.392