Answer:

Present Value (PV) of cash flows are as follows.

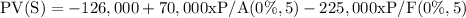

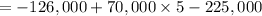

(i) Discount rate = 0%

= - 1

Since PV < 0, the project should not be undertaken.

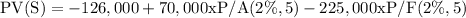

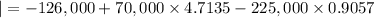

(ii) Discount rate = 2%

= 156

Since PV > 0, the project should be undertaken.

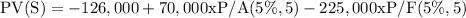

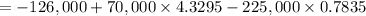

(iii) Discount rate = 5%

= 772

Since PV > 0, the project should be undertaken.

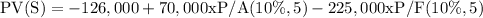

(ii) Discount rate = 10%

= - 351

Since PV < 0, the project should not be undertaken.