Answer:

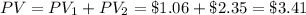

- The maximum price that a prudent investor would be willing to pay for a share of Valorous Corporation stock today is $3.41

Step-by-step explanation:

Assuming that today is the first day of the year, you wil receive, per share:

- a $1.75 dividend in one year

- a $2.35 dividend in two years

- the $41 stock value in two years

How do you calculate the value today of those cash flows that you can expect to receive?

That is the present value of that stream of cash flow, which is calculated discounting each cash flow at a rate equal to the cost of capital of 9%, accoding the to time of payment:

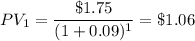

a) $1.75 dividend in one year

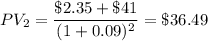

b) $2.35 dividendand $41 stock value in two years

c) Total present value

Thus, the maximum price that a prudent investor would be willing to pay for a share of Valorous Corporation stock today is $3.41