Answer:

0.28 yr

Explanation:

To find the doubling time with continuous compounding, we should look at the formula:

FV = future value, and

PV = present value

If FV is twice the PV, we can calculate the doubling time, t

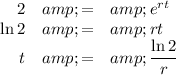

1. Samuel's doubling time

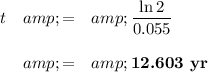

2. Claire's doubling time

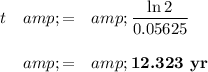

3. Samuel's doubling time vs Claire's

12.603 - 12.323 = 0.28 yr

It would take 0.28 yr longer for Samuel's money to double than Claire's.