Answer:

The cost of goods sold per tie was $22

Explanation:

The list of all associated cost in a month on the job 1041 is

- Direct materials - $54,800

- Direct Labour - $19,200

- Selling $ Shipping Costs - $28,000

- Overhead costs - $25 per MH × 320MHs = $8,000

The total cost of production of the ties can then be obtained by adding all associated costs;

$54,800 + $19,200 + $28,000 + $8,000 = $110,000

Total units of ties made from Job 1041 is 5,000

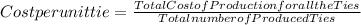

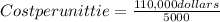

Therefore,

Cost per unit tie = $22