Answer:

Part A: The value of the simple interest investment at the end of three years is $12,220

Part B: The value of the compounded quarterly interest investment at the end of three years is $12,134.08

Part C: The simple interest investment is better over the first three years

Part D: I advise George to invest his money in the compounded interest investment if he will keep the money for a long time

Explanation:

Part A:

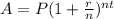

A = P + P r t, where

- A represents the value of the investment

- P represents the original amount

- r represents the rate in decimal

- t represents the time in years

∵ George deposits $10,000

∴ P = 10,000

∵ First option offers 7.4% per year simple interest

∴ r = 7.4% = 7.4 ÷ 100 = 0.074

∵ He may not withdraw any of the money for three years after

the initial deposit

∴ t = 3

- Substitute all of these values in the formula above

∴ A = 10,000 + 10,000(0.074)(3)

∴ A = 10,000 + 2,220

∴ A = 12,220

The value of the simple interest investment at the end of three years is $12,220

Part B:

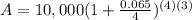

, where

, where

- A represents the value of the investment

- P represents the original amount

- r represents the rate in decimal

- n is a number of periods of a year

- t represents the time in years

∵ George deposits $10,000

∴ P = 10,000

∵ The second option offers a 6.5% interest rate compounded quarterly

∴ r = 6.5% = 6.5 ÷ 100 = 0.065

∴ n = 4 ⇒ quarterly

∵ He may not withdraw any of the money for three years after

the initial deposit

∴ t = 3

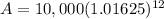

- Substitute all of these values in the formula above

∴

∴

∴ A = 12,134.08

The value of the compounded quarterly interest investment at the end of three years is $12,134.08

Part C:

∵ 12,220 > 12,134.08

∴ The simplest interest investment is better than the compounded

interest investment at the end of three years

The simple interest investment is better over the first three years

Part D:

I advise George to invest his money in the compounded interest investment if he will keep the money for a long time

Look to the attached graph below

- The red line represents the simple interest investment

- The blue curve represents the compounded interest investment

- (Each 1 unit in the vertical axis represents $1000)

- After 0 years and before 4.179 years the red line is over the blue curve, that means the simple interest is better because it gives more money than the compounded interest

- After that the blue curve is over the red line that means the compounded quarterly is better because it gives more money than the simple interest