Answer:

A) -9,289,924.80

B) -8,268,360.00

Step-by-step explanation:

To solve for the first part, we have to solve for the futue value of a lump sum

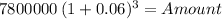

Principal 7,800,000.00

time 3.00

rate 0.06000

Amount 9,289,924.80

As this is future worth, te value will be negative.

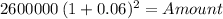

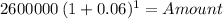

Then, we solve for thre payment equally at the end of each year:

7,800,000 / 3 = 2,600,000

1st 2nd 3rd

=------/------/------/

The first capitalize for 2 period

the second for one period and te third for none.

Amount 2,921,360.00

Amount 2,756,000.00

Third year 2,600,000

Total worth = 8,268,360