Answer:

Bond X $1,205.41

as it was issued at premium I expect the bond price to decrease as time passes to match the maturity value

Bond Y $820.69

As it is below face value and at maturity the company with the coupon will receive 1,000 this value of 820.59 will increase over time to match it.

Step-by-step explanation:

The market value of the bond will the present value of the coupon payment and maturity considering the yield to maturity rate

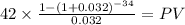

Bond X

C 42.000 (1,000 x 0.084 / 2 )

time 34 (17 years x 2 payment per year)

rate 0.032 (0.064 annual / 2 semiannual )

PV $862.7309

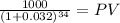

Maturity 1,000.00

time 34.00

rate 0.032

PV 342.68

PV c $862.7309

PV m $342.6812

Total $1,205.4121

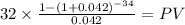

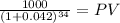

Bond Y

PV $573.8007

PV 246.89

Total $820.6873