Answer:

A. $.45

Explanation: Right shares refer to those shares offered by a company which confer a right on their employees, which they may exercise and buy company's shares at a reduced price than which those are offered in the market.

Right shares require fulfillment of certain employment conditions which pertain to the length of the service of the employees post which they become eligible.

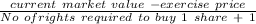

The value of right shares can be determined using the following formula

Therefore, as on exercise date, the value of right is,

=

= $0.4545 or $0.45 approx