You did not post the complete question so I will write only the missing components below that is needed to answer the question and some important definitions.

Definitions:

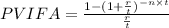

PVIFA - present value interest factor of annuity

= number of regular intervals per year at which time the borrowed amount is to be paid back

= number of regular intervals per year at which time the borrowed amount is to be paid back

= annual interest rate

= annual interest rate

= number of years to payoff the debt

= number of years to payoff the debt

We need to find the interest rate that equates the price we paid for the bond with the cash flows we received. The cash flows we received were $100 each year for two years and the price of the bond when we sold it. Also, remember the YTM on the bond has declined by 1 percent.

Let us assume a par value of $1,000. we need to find the price of the bond in two years. The price of the bond in two years, at the new interest rate, will be:

$100(PVIFA8.42%,17) + $1,000(PVIF8.42%,17) = $1,139.69

Answer:

Therefore, the bond will sell for $ 1,139.69 ± 0.1%