Answer:

1. The nominal interest rate is 16.67%

2. The effective interest rate is 4.17%

Explanation:

1.firstly we use the information given:

face value of bill is$100 which is denoted by Fv below.

$96 is the present value Pv of the bill denoted below.

thereafter we have n the number of periods of compounding which is 1 period.

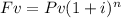

we use the following formula for this problem to find i the nominal interest rate:

then we substitute the above mentioned values.

$100 = $96 ( 1+i/m)^1 divide both sides by $96

(100/96) = 1+ i/4 then subtract both sides by 1

(100/96)- 1 = i/4

0.0416666666667 = i/4 then multiply by 4 both sides as this was compounded quarterly so four times a year then multiply by 100 for percentage.

16.67% = i which is the nominal interest rate

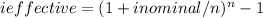

2.

ieffective= (1+16.67%/4)^1 - 1

ieffective = 4.17%