Answer:

$1086 approx.

Step-by-step explanation:

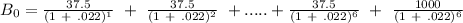

Given: Coupon rate 7.5 % per annum i.e 3.75% semi annually

YTM = 4.4% per annum i.e 2.2% semi annually

Face value: $1000 (assumed)

No of periods to maturity = 3 years × 2 half years = 6 periods

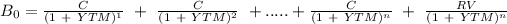

Value of a bond is given by the following equation

where

= Market value of bond

= Market value of bond

C= Coupon payment each period

YTM = Yield to maturity rate

n= no of periods

Hence,

= 5.5638 × 37.5 + 1000 × .8776

= 208.64 + 877.60

= 1086.24

Market value of the bond is $1086 approx

This means, the bond is valued above par or priced at a premium. The reason being, it's rate of coupon payments being higher than it's yield to maturity rate.