Answer:

6291.26$

Step-by-step explanation:

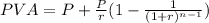

In order to calculate the present value of the cash flow, we apply the formula for the present value of annuity due:

where:

P is the value of the periodic payment

r is the discout rate

n is the number of periods

In this problem, we have:

(periodic payment)

(periodic payment)

n = 11 y (number of years)

(discount rate is 7.5%)

(discount rate is 7.5%)

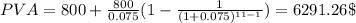

Therefore, the present value of the cash flow is: