Answer:

The equations are missing but we can solve the problem from the given information

The equation

can be used to solve for the principal P for which the cards offer the same deal over the course of a year

can be used to solve for the principal P for which the cards offer the same deal over the course of a year

Explanation:

The formula of the compounded interest is

, where

, where

- A is the future value of the investment/loan, including interest

- P is the principal investment amount

- r is the annual interest rate (decimal)

- n is the number of times that interest is compounded per unit t

- t is the time the money is invested or borrowed for

Card A:

∵ Credit card A has an APR of 19.3% and an annual fee of $84

∴ r = 19.3% = 19.3 ÷ 100 = 0.193

∴ Annual fee = 84

∵ Interest is compounded monthly for a year

∴ n = 12 and t = 1

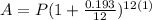

- Substitute the values of r, n and t in the formula above

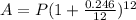

∴

- Add the value of the annual fee

∴

Card B:

∵ Credit card B has an APR of 24.6% and no annual fee

∴ r = 24.6% = 24.6 ÷ 100 = 0.246

∴ Annual fee = 0

∵ Interest is compounded monthly for a year

∴ n = 12 and t = 1

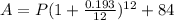

- Substitute the values of r, n and t in the formula above

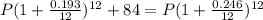

∴

∴

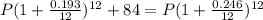

- Equate The equations of cards A and B

∴

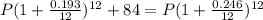

The equation

can be used to solve for the principal P for which the cards offer the same deal over the course of a year

can be used to solve for the principal P for which the cards offer the same deal over the course of a year