Answer:

Machine A $ 93,014.34

Machine B $ 82,681.80

Machine C $ 87.545,44

Machine B would be the best option as their net worth is lower.

Step-by-step explanation:

We calcualte the present valeu of the maintenance cost like they were annuities. Then, we add the cost for the machine. in the case of machine C we will discount the salvage value

we will pick the lower of the cost.

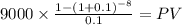

Machine A

C 9,000.00

time 8

rate 0.1

PV $48,014.3358

+ cost 45,000

net worth $ 93,014.34

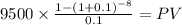

machine B

C 9,500.00

time 8

rate 0.1

PV $50,681.7989

+ 32,000 cost

net worth: 82,681.80

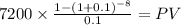

machine C

C 7,200.00

time 8

rate 0.1

PV $38,411.4686

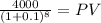

salvage value

Maturity $4,000.0000

time 8.00

rate 0.10000

PV 1,866.0295

cost: 51,000

net worth: 51,000 + 38,411.47 - 1,866.03 = 87.545,44