Answer:

$94,669 approx

Step-by-step explanation:

Given: Amount of Loan = $1 million

Internal Rate of Return = 4%

Period = 14 years

Assumption: It has been assumed this being a case of deferred annuity wherein annual installments are payable at the end.

Equated Annual Investment = Borrowed Sum/ Cumulative present value of cash flows for 14 years

Cumulative present value factor at the rate of 4% for 14 years is calculated using the following formula.

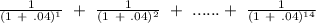

=

= 10.5631

= 10.5631

Equated Annual Installment = $10,00,000/10.5631

Equated Annual Installment each year = $10,00,000/10.5631 = $94,669 approx.