Answer:

5.64% per annum

Step-by-step explanation:

INVESTMENTS PRICE VALUE($) WEIGHTS

100 shares of SPY $112 11200 11200/21200 = 0.53

100 shares of AGG $100 10000 10000/21200 = 0.47

Total Investment 21200

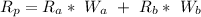

Return of a portfolio is the weighted average return of individual securities in a portfolio. It is expressed and calculated using following formula,

= .08 × 0.53 + .03 × 0.47

= .08 × 0.53 + .03 × 0.47

= .05636 or 5.64% p.a

= .05636 or 5.64% p.a

Hence expected return for investment would be 5.64%

Expected return of a portfolio represents anticipated rate of return on similar stocks. Expected rate of return is the probable rate of return and is thus usually determined using the probability.