Answer:

(A) $1,055.35 (B) $2,180.53 (C) $780.07 (D) $412.08.

Step-by-step explanation:

The tenor of the bond is 27 years i.e. (27 * 2=) 54 periods of 6 months each (n).

Face Value (F) = $1,000

Coupon (C) = 6% annually = 3% semi annually = (3% * 1000 face value) = $30.

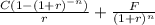

The Present Value (PV) of the Bond is computed as follows.

PV of recurring coupon payments + PV of face value at maturity

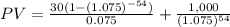

=

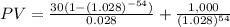

A) Yield = 5.6% annually = 2.8% semi annually.

= 830.25 + 225.10

= $1,055.35.

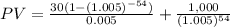

B) Yield = 1% annually = 0.5% semi annually.

= 1,416.64 + 763.89

= $2,180.53.

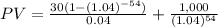

C) Yield = 8% annually = 4% semi annually.

= 659.79 + 120.28

= $780.07.

D) Yield = 15% annually = 7.5% semi annually.

= 391.95 + 20.13

= $412.08.