Answer:

DMF paying to borrow money at 7.78% return per year

Step-by-step explanation:

given data

future value = $100,000

present value = $22,364

time period t = 20 year ( March 28, 2008 to March 28, 2028 )

solution

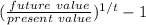

we get here rate of interest by the future value formula that is express as

rate =

...............................1

...............................1

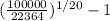

put here value and we get rate of interest that is

rate =

solve it and we get

rate = 0.0778

rate = 7.78 %

so DMF paying to borrow money at 7.78% return per year