Answer:

It would be better to buy the car.

Nominal 26,446.81 (break even resale price)

Step-by-step explanation:

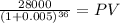

We solve the present value of the salvage value at 6% APR

Maturity $28,000.0000

time 36.00

rate 0.00500

PV 23,398.0577

Net present worth:

23,398.06 - 43,000 = 19,601.94

Lease option

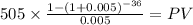

PV of the monthly payment:

C 505.00

time 36

rate 0.005

PV $16,599.8632

plus the 4,300 downpayment

present worth: -20.899,86

As the option from the purcahse gives a lower present worth it is preferable over the option to lease the vehicle

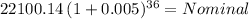

X - 43,000 = -20,899.86

X = 22,100.14

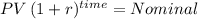

We have to look at which resale price the present value is equal to 22,100.14

Principal 22,100.14

time 36.00

rate 0.00500

Nominal 26,446.81