Answer:

if YTM at 4% price : $2,902.1237

if YTM at 8% price : $1,788.0448

The bonds are above face value asthey offer a higher coupon payment than the market yield therefore the bond holders are willing to pay above theri face value

Step-by-step explanation:

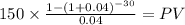

the market price of the bond will be the present value of coupo payment and maturity:

C 150.000

time 30

rate 0.04

PV $2,593.8050

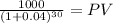

Maturity 1,000.00

time 30.00

rate 0.04

PV 308.32

PV c $2,593.8050

PV m $308.3187

Total $2,902.1237

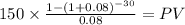

No we repeat the process with the yield at 8%

C 150.000

time 30

rate 0.08

PV $1,688.6675

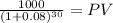

Maturity 1,000.00

time 30.00

rate 0.08

PV 99.38

PV c $1,688.6675

PV m $99.3773

Total $1,788.0448